|

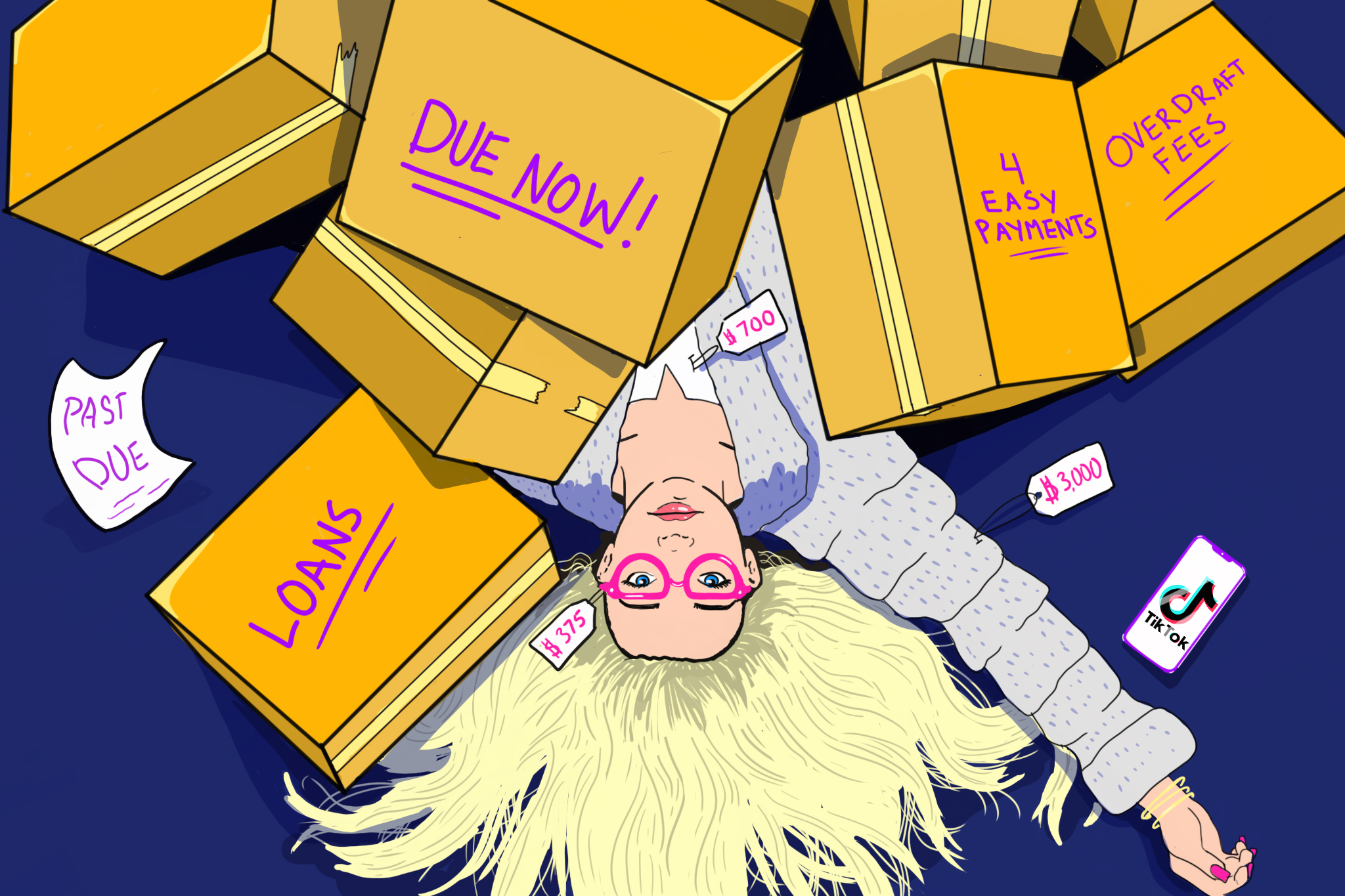

From the Editor's Desk You may have seen some of these names - Klarna, Sezzle, Zip (formerly Quadpay), Afterpay and Affirm - pop up as you shop online, presenting an easier, more seamless alternative to having to type out your credit card information again and again. With a few clicks and a small down payment, you'll have what you ordered on hand - all you need to do now is complete your four payments. |

Wednesday 17th April 2024

-->

-->

Top stories this week